Small Business Corporate Tax Audit

Small businesses form the backbone of the Canadian economy, but they are not exempt from scrutiny by the Canada Revenue Agency (the “CRA”). A small business corporate tax audit is conducted to ensure that income is reported accurately, deductions are legitimate, and taxes are paid in full. While audits may feel overwhelming, they are a routine part of the CRA’s compliance efforts. Understanding why they occur and how they work is the first step in preparing effectively.

Common Triggers for a Small Business Corporate Tax Audit

The CRA uses data analysis, third-party reporting, and industry comparisons to identify businesses at higher risk of underreporting. For small businesses, some of the most common triggers include:

- Large or unusual expenses claims without proper documentation

- Discrepancies between reported income and bank deposits

- Persistent reporting of business losses year after year

- Operating in cash-heavy industries such as restaurants, construction, or retail

- Significant changes in income or deductions compared to prior years

Being aware of these red flags can help small business owners take steps to reduce their audit risk.

How the CRA Notifies Businesses of an Audit

If selected for an audit, the CRA will typically send a written notice identifying the taxation years under review and the specific records required. In some cases, a preliminary phone call may precede the written notice. This communication should be treated seriously, and businesses should begin organizing documentation immediately.

Stages of a Business Corporate Tax Audit

Initial Planning

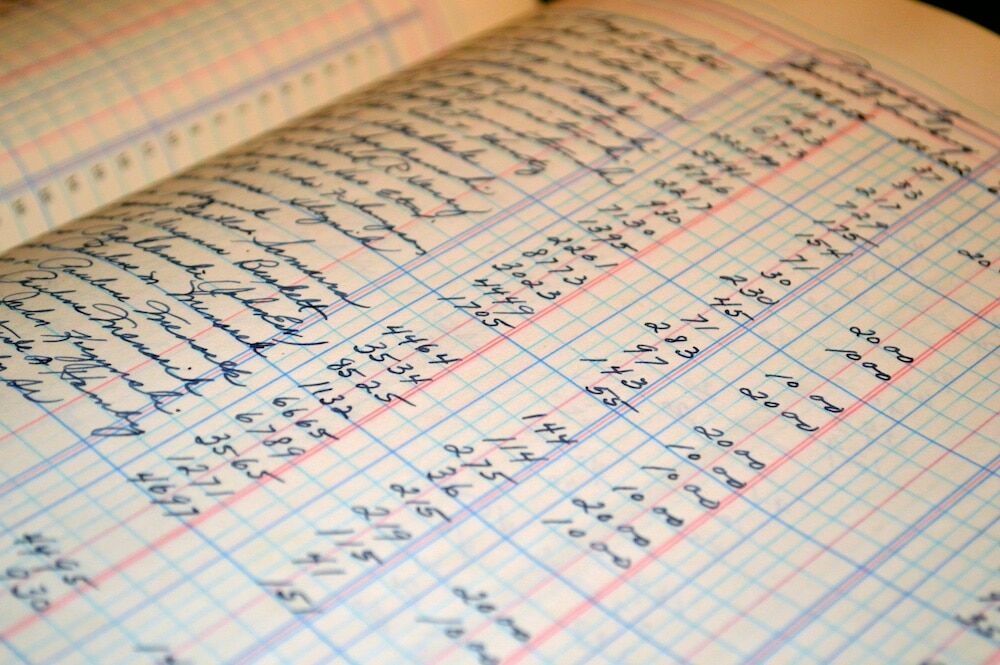

An auditor will explain the scope of the audit and request supporting documents such as financial statements, invoices, receipts, payroll records, and bank statements. Small businesses should use this stage to gather all relevant materials and consider obtaining legal advice.

Review of Records

Depending on the complexity of the case, the CRA may conduct the review at its office or at the place of business. For small businesses, on-site audits are more common, as auditors may want to review accounting systems, examine sales records, and confirm internal processes.

Findings and Proposal

Once the auditor reviews the documents, they will prepare a proposal outlining potential reassessments. Small businesses are given the opportunity to respond, clarify, or submit additional evidence before a final decision is made.

Final Reassessment

If the CRA concludes that changes are necessary, a reassessment will be issued. This may result in additional taxes, interest, and penalties. If no issues are identified, the CRA will close the audit without adjustments.

How Long Does a Small Business Audit Take?

The length of an audit varies, but small business corporate tax audits typically take three to six months if records are well organized. More complex cases involving multiple taxation years or incomplete documentation can extend beyond one year. Businesses that respond quickly and thoroughly tend to experience shorter timelines.

Rights and Responsibilities During an Audit

Small businesses have the responsibility to provide accurate records and cooperate with auditors. At the same time, they have important rights, including:

- The right to professional representation

- The right to be treated with respect and fairness

- The right to appeal reassessments through the CRA’s objection process

Knowing these rights ensures that small business owners can navigate audits confidently.

Practical Tips for Small Businesses Preparing for an Audit

- Keep all financial records organized and up to date throughout the year

- Separate personal and business expenses to avoid confusion

- Avoid aggressive deductions that cannot be substantiated with documentation

- Respond to CRA requests promptly and completely

- Consult a tax lawyer for advice on strategy and communication with auditors

Schedule a Free Consultation

If your small business has been contacted about a CRA corporate tax audit, the best defence is preparation and professional guidance. Schedule a free consultation with Rosen & Associates Tax Law to protect your rights and ensure your business is fully prepared.

Disclaimer: This article provides information of a general nature only. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in this article. If you have specific legal questions, you should consult a lawyer.