Fijal v. The King

In Fijal v. The King, the Tax Court of Canada addressed a complex tax dispute between the taxpayer, Mr. Fijal, and the Canada Revenue Agency (CRA) con...

Canada Emergency Business Account (CEBA) Loan Forgiveness

During the Covid-19 pandemic, the Canada Emergency Business Account (CEBA) provided a lifeline for many businesses by offering interest free loans to ...

Tax Implications of Spousal Support Payments in Canada

Navigating the tax landscape of spousal support payments can be complex, but it is essential for ensuring compliance with Canadian tax laws. Managing ...

The Public Service Bodies’ Rebate

Charities often operate with tight budgets while delivering essential services. To support these vital organizations, the government offers a valuable...

SCC Dismissed Glencore Canada’s Application for Leave to Appeal

The Supreme Court of Canada (“the SCC”) recently dismissed Glencore Canada Corporation’s application for leave to appeal the FCA’s 2024 decisi...

A Fairer Future for Canada’s Younger Generation: The 2024 Federal Budget

Canada has long been recognized as a land of opportunity, where generations have thrived thanks to progressive taxation, a strong social safety net, a...

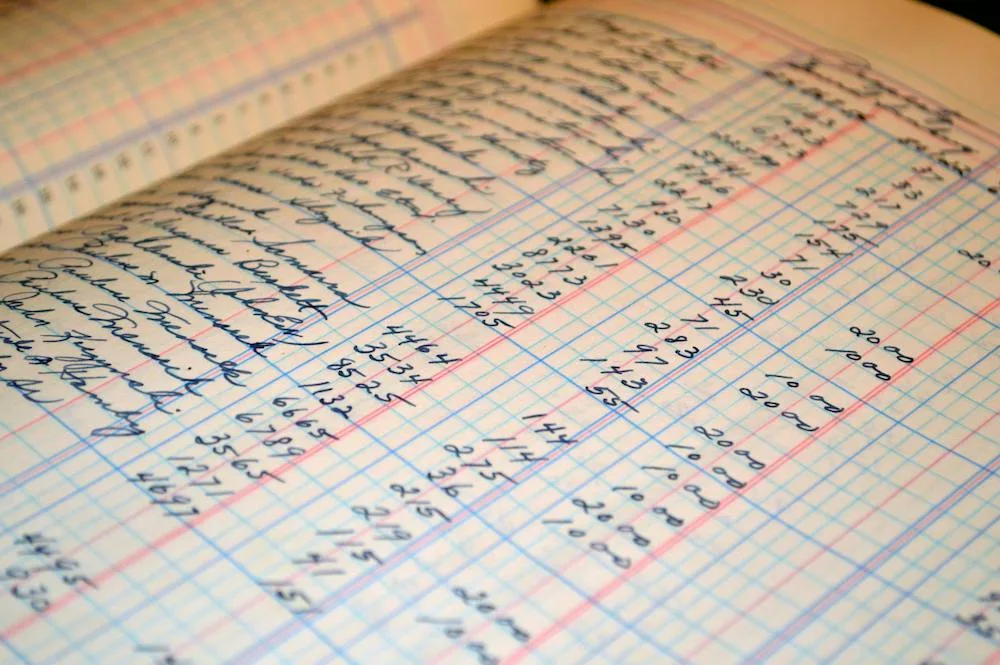

CRA (Re)Assessments & Subsection 152(4) of the Income Tax Act

What a Taxpayer Needs to Know About CRA (Re)Assessments & Subsection 152(4) of the Income Tax Act The Canada Revenue Agency (CRA) has several key ...

Can you be Detained at the Canadian Border for Tax Debt?

Whether you owe $50 or $50 million to the Canada Revenue Agency (“CRA”), tax debt is undoubtedly a source of stress. This is partially due to the ...

New CRA Powers in the 2024 Federal Budget: “Notices of Non-Compliance”

Budget 2024 proposes several amendments to the information gathering provisions of the Income Tax Act (“ITA”), notably “Notices of Non-Compl...