The Burden of Proof in CRA Disputes: What Taxpayers Must Show

One of the most common misconceptions amongst taxpayers involved in disputes with the Canada Revenue Agency (“CRA”) concerns who bears the burden ...

Understanding Canada’s General Anti-Avoidance Rule

Effective tax planning is important for both individuals and businesses. Good planning helps you meet your legal obligations while arranging your affa...

Tax Controversy: How Tax Disputes with the CRA Are Resolved

Tax controversy refers to disputes between taxpayers and the Canada Revenue Agency (“CRA”) over the interpretation or application of the governing...

New CRA Powers for Notices of Non- Compliance – Proposed in the 2025 Federal Budget

In the 2025 Federal Budget, the Canadian government proposed plans to introduce a new tool for the Canada Revenue Agency (“CRA”) called a Notice o...

Foreign Tax Credits: Common Errors and CRA Adjustments

When Canadians earn income abroad, through employment, investments, or business activities, that income is typically taxed in the country where it’s...

Considering Hiring Family to Help Run Your Business? Ensure you Understand CRA Requirements to Stay Compliant

Thinking of hiring your spouse to handle bookkeeping or your teen to help with marketing? While keeping business “in the family” sounds ideal, the...

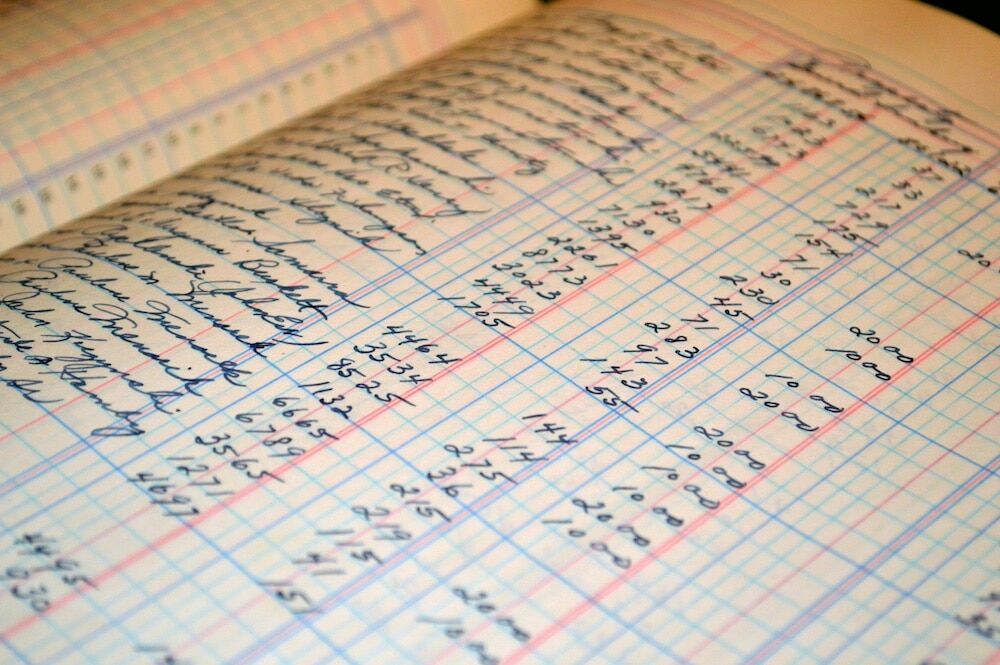

Surviving the CRA’s Net Worth Audit

Navigating a Canada Revenue Agency’s (“CRA”) Net Worth Audit is a complex and stressful challenge for Canadian taxpayers, but with careful plann...

Is the CRA Failing the Taxpayers? What Taxpayers Need to Know

What Taxpayers Need to Know (and How to Protect Themselves): A Report by the Office of the Auditor General of Canada. When Canadians call the Canada R...

Navigating the CRA Objection Process: What Every Taxpayer Should Know

If you have received a decision, Notice of Assessment, Reassessment, or Determination from the Canada Revenue Agency (“CRA”), filing a Notice of O...