Surviving the CRA’s Net Worth Audit

Navigating a Canada Revenue Agency’s (“CRA”) Net Worth Audit is a complex and stressful challenge for Canadian taxpayers, but with careful planning and professional support, a strong defence is possible. The CRA conducts net worth audits to determine whether your reported income matches your financial reality. This method is often used if your lifestyle, assets, or banking records appear inconsistent with your declared income or if your records are incomplete. The auditor adds up all assets (cash, property, investments), subtracts liabilities, and factors in living expenses. If your net worth increases more than your reported income explains, the CRA might reassess you for unreported income and impose penalties.

Why You Might Be Audited

Net worth audits generally target:

- Large or frequent cash deposits with unidentifiable source

- Unexplained asset purchases or rapid increases in wealth

- A lifestyle that appears inconsistent with reported income

- Significant discrepancies between business and personal accounts

- Anonymous tips or data from other government agencies

Often, the CRA is empowered to use assumptions and indirect evidence when your books are unreliable, and the onus is on you, the taxpayer, to explain discrepancies. This is referred to as the Indirect Verification of Income Tax (“IVI”) method to estimate a taxpayer’s income. These audits can be complex, invasive, and can have significant financial and legal consequences if not managed properly.

What Happens During the Audit

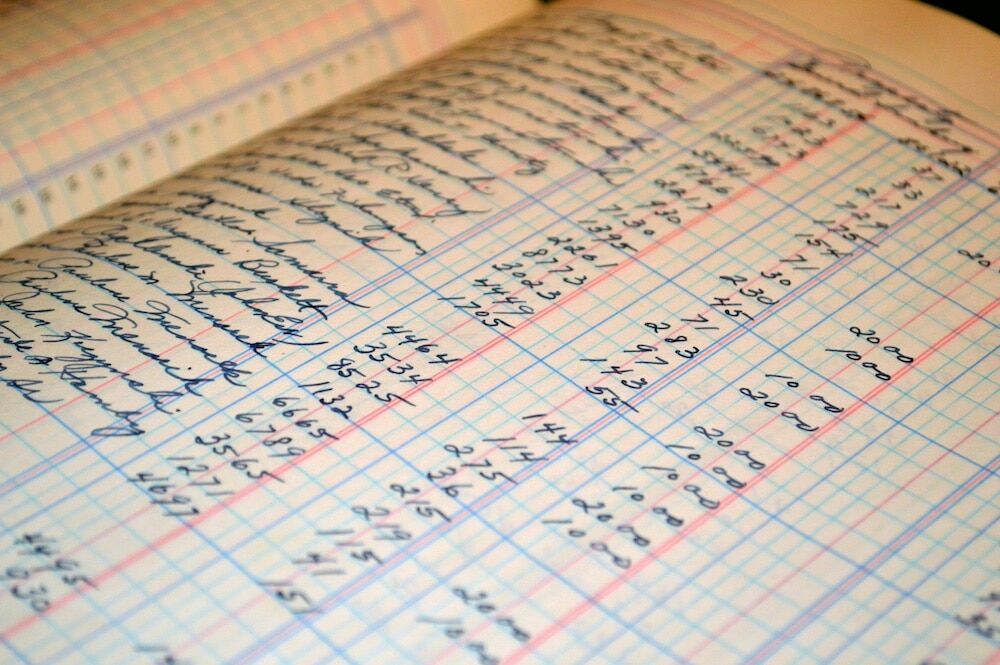

CRA auditors request extensive documentation, including bank records, asset registrations, and even records of related parties (family or corporations). The audit can span any duration of time from a few months to several years, examining your assets, liabilities, and expenditures. Unfortunately, traditional accounting records become secondary—the CRA will rely significantly on reconstructing your financial activity directly from the source documents. The Net Worth Audit is not an exact science. It largely depends on the CRA’s interpretation of asset values, living costs, and personal circumstances. These assumptions are frequently open to challenge, especially when taxpayers can provide clear, detailed documentation. A net worth audit finding is presumed correct unless you prove otherwise—a “guilty until proven innocent” scenario.

What to Expect

A Net Worth Audit generally begins when the CRA sends a formal audit letter requesting comprehensive information about the taxpayer’s assets, liabilities, income, and spending habits. The CRA often requests:

- Personal and business bank statements

- Mortgage, loan, and credit card records

- Property and vehicle ownership documents

- Investment account statements

- Household expense information

A common mistake often made by taxpayers is ignoring the CRA’s request for financial disclosure. This is a mistake because the CRA has the legal authority to issue “Requests for Information” directly to your banks and other third parties for these documents. If you fail to provide information yourself, the CRA will obtain it directly, without your ability to explain or contextualize certain transactions. Once the CRA collects the relevant financial data, it calculates your net worth—your total assets minus total liabilities—for each year under review. It then compares the change in your net worth from year to year to your reported income to determine whether your wealth increased more than your declared income can explain.

Household Finances and Net Worth Audits

When the CRA conducts a Net Worth Audit, it does not just look at the named taxpayer in isolation. Instead, auditors often assess the entire household’s net worth to get a more complete picture. This means the CRA will include the assets, liabilities, and expenditures of a spouse or common-law partner, and sometimes even adult children who share living expenses. The logic is that family members living under one roof often share common resources. Shared financial resources are often used for mortgage payments, car loans, household bills, or vacations, and these shared costs can obscure the true source of funds.

Conclusion

A CRA Net Worth Audit can feel intrusive and overwhelming, but understanding how the technique works empowers you to respond strategically. The CRA’s calculations are often based on estimates, and with proper documentation and professional representation, those estimates can be effectively challenged. If you have been contacted by the CRA regarding a Net Worth Audit in Ontario, our experienced tax lawyers can help you navigate the process, protect your rights, and achieve the most favourable resolution possible.

Schedule your free consultation now

Disclaimer: This article provides information of a general nature only. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in this article. If you have specific legal questions, you should consult a lawyer.