Can’t Pay Taxes on Time? What to Do

Finding yourself unable to pay your taxes on time can be stressful and overwhelming. Whether due to financial hardship, unexpected expenses, or simply...

Income Splitting: A Strategy for Tax Savings

Income splitting is a tax strategy that can significantly reduce a family’s overall tax burden by shifting income from a higher-income earner to...

Tax Implications of Gifting Large Sums of Money

Gifting large sums of money can be a generous way to support family members, friends, or charitable organizations. However, it’s essential to un...

Foreign Tax Credits: Guide for Canadian Taxpayers

For Canadians earning income abroad or paying taxes to foreign governments, the foreign tax credit is a valuable tool to prevent double taxation. With...

Director’s Liability in Canada: Understanding Legal Responsibilities

In Canada, directors of corporations bear significant responsibilities and may face personal liability for certain actions or failures of the company....

Estate Freeze: A Tax Strategy for Wealth Preservation

An estate freeze is a sophisticated tax strategy often used by business owners and high-net-worth individuals to minimize the tax burden on their esta...

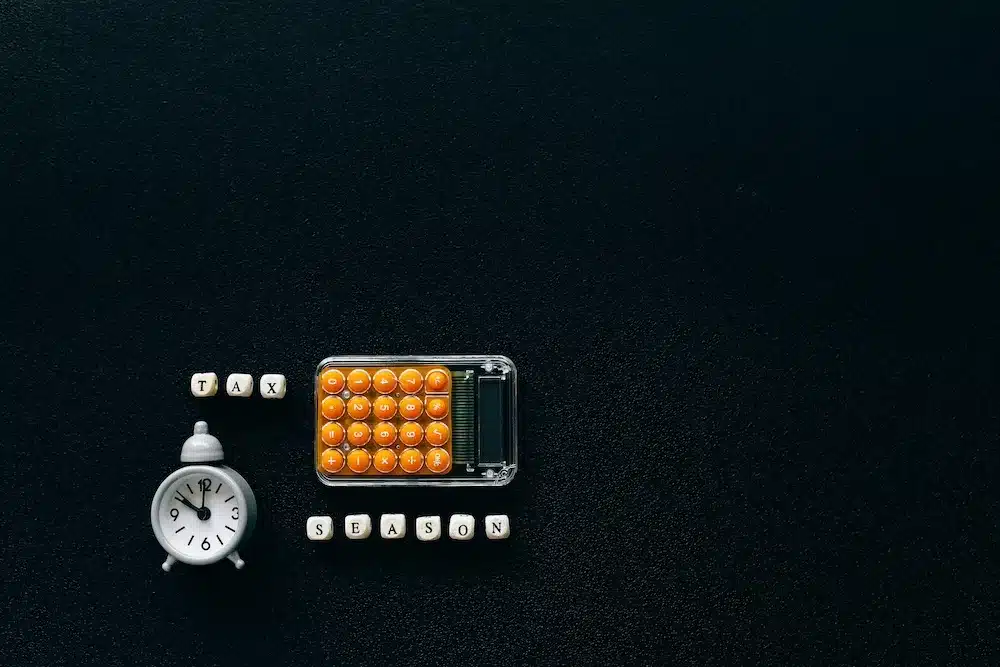

Understanding the Alternative Minimum Tax (AMT) in Canada

The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income earners and individuals with substantial deductions pay...

T2202 Form (Tuition and Enrolment Certificate) in Canada

The T2202 form, also known as the Tuition and Enrolment Certificate, is a vital document for students in Canada who are eligible to claim tuition fees...

T1213 Form (Request to Reduce Tax Deductions at Source)

The T1213 form, also known as the Request to Reduce Tax Deductions at Source, is a valuable tool for Canadian taxpayers who expect to claim significan...