Changes to the Voluntary Disclosures Program

Do you have unfiled tax returns, or have you incorrectly reported income? If so, you may be eligible for the Voluntary Disclosures Program. The Volunt...

I Owe Money to the CRA – What do I do?

So you filed a personal, corporation, or GST/HST return but you weren’t able to cover the balance owing to the Canada Revenue Agency (“CRA...

How To Find The Right Tax Court Lawyer

The Tax Court of Canada is a unique Court in Canada. It only hears tax cases, and there is no fixed location where the judges reside. Rather, Tax Cou...

How Professionals Incorporate To Save On Taxes

Professional Corporations Legislation in Ontario specifically permits certain professionals to practice their profession in a corporate form even thou...

Owing Money To The CRA: Tom’s Story Part 1

Tom Johnson runs a successful sole proprietorship in Toronto, Ontario. He buys consumer goods that he finds online for cheap, and then re-sells them ...

Incorporation vs. Sole Proprietorship

When a taxpayer decides to start their own business, he or she must consider the type of business structure best suited to their individual needs. The...

Section 85 Rollover

What is a Section 85 Rollover? The Income Tax Act (“ITA”) contains several provisions that allow a taxpayer to transfer ownership of prop...

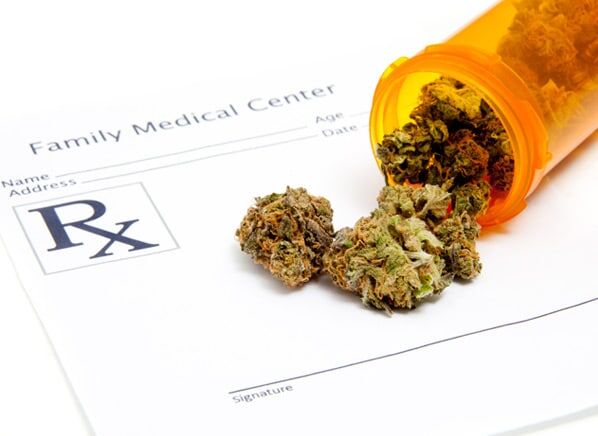

Marijuana Dispensaries and Taxes

With the recent explosion of marijuana dispensaries in Vancouver and Toronto, the Canadian government is having a hard time coming up with new laws ...

Real Estate Audit

The Principal Residence Exemption is Canada’s most lucrative tax break. When a taxpayer sells his or her personal residence, providing the con...