When You Need A Tax Lawyer vs. When You Need An Accountant

There are clear distinctions to be made between tax lawyers and accountants. Understanding these differences will make it easier to decide what you are in...

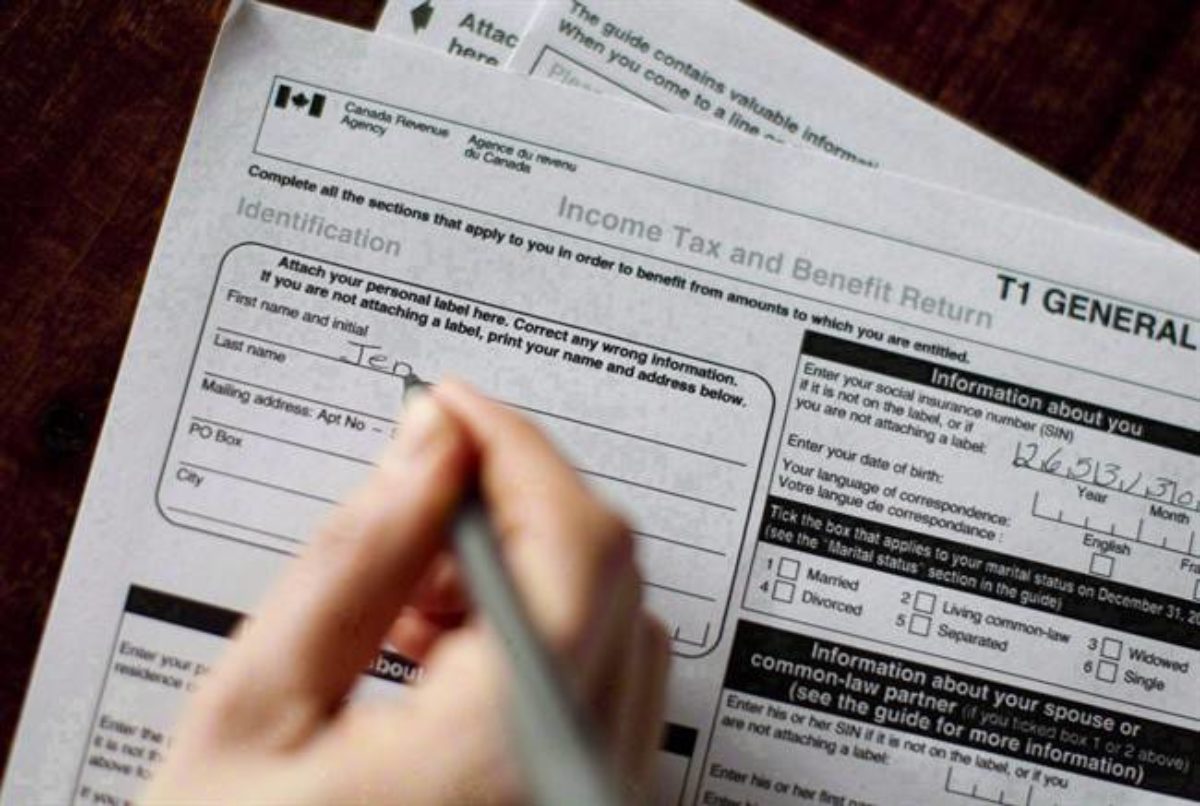

Read MoreCan I File An Income Tax Objection?

If you feel as though the CRA has not interpreted the law correctly in their tax audit, it is within your rights to challenge it through the Income Tax...

Read MoreWhat To Do If Your Disagree With The CRA On Your Tax Return

There are a number of steps you can take if you suspect the CRA has made a mistake in their audit regarding the legitimacy of your tax return. It might be...

Read MoreI’m Being Audited By The CRA, What Should I Do?

Depending on your employment position, it should not be a surprise to find yourself the target of a CRA audit. If you are self-employed, the owner of a...

Read MoreWhat Happens If You Forget To Report Income On Your Tax Returns

Forgetting to report income is a common issue pertaining to tax returns and audits. If you are reporting numerous employment incomes, have a plethora of...

Read MoreRRSP or TFSA – Which is Right for Me?

If you want to begin saving for retirement, but are not maxing out the tax-sheltered savings accounts offered by the Canada Revenue Agency, you will face a...

Read MoreChanges to the Lifetime Capital Gains Exemption

On July 18, 2017, Canada introduced draft legislation that, if implemented, will significantly change the way business owners and professionals pay tax....

Read MoreChanges to the Voluntary Disclosures Program

Do you have unfiled tax returns, or have you incorrectly reported income? If so, you may be eligible for the Voluntary Disclosures Program. The Voluntary...

Read More